Billing Software That Helps You Create Invoices and Track Payments in Seconds

Running a small business today isn’t easy. You need to move fast, serve customers well, and keep your numbers in check. Old methods like paper bills or spreadsheets can slow you down. They cause mistakes, waste time, and delay your payments. That’s why many business owners now use billing software that helps you create invoices […]

What Makes a Construction Site Efficient?

It is extremely important to have efficiency in all construction projects in order to complete the job on time, on budget and to a high standard. Various elements contribute to efficiency on site, including but not limited to the right equipment, skilled labor, proper planning on site, and maintenance. For example, all smart construction managers […]

How Remote Teams Can Boost Business Growth and Efficiency

The modern workplace is evolving, with traditional office setups being replaced by flexible and remote work arrangements. Faced with the daily challenges of maintaining productivity and engagement, businesses are turning to remote teams as a powerful solution. Have you ever wondered how organizations leverage remote teams to not only survive but thrive in today’s competitive […]

Finding Satisfaction Through Intentional Spending

When we think about spending money, we often focus on what we’re buying or how much we’re saving. But what if the real key to happiness with money isn’t about how much you spend or save — but how intentionally you do it? Intentional spending is all about making financial choices that line up with […]

Best Practices for Sourcing Reliable Used Warehouse Equipment

Sometimes, buying brand-new warehouse equipment just isn’t realistic due to the cost factor. The budget doesn’t allow it, or maybe the need is temporary. Either way, used equipment becomes the apparent alternative. And honestly, in the proper context, it makes a lot of sense. But here’s the thing—used doesn’t always mean dependable. You’ve probably seen […]

Master Your Credit Score with Just One App – OneScore

When you’re looking for a personal loan, the whole process can feel a little complicated when you use multiple apps. You’ve got one app to check your credit score, others to keep track of various loan repayments, and multiple loan apps to find the best offer for current needs. It’s a confusing system that’s pretty […]

Elevating Efficiency with Managed Service Providers: Strategies for Smarter IT Operations

Why Modern Businesses Embrace Managed Service Providers Managed Service Providers (MSPs) have become indispensable for businesses navigating today’s IT requirements. As organizations manage distributed workforces, contend with increasing cybersecurity threats, and maintain complex IT infrastructures, MSPs offer solutions to reduce strain and improve performance. Studies illustrate why these services are vital: downtime costs average businesses […]

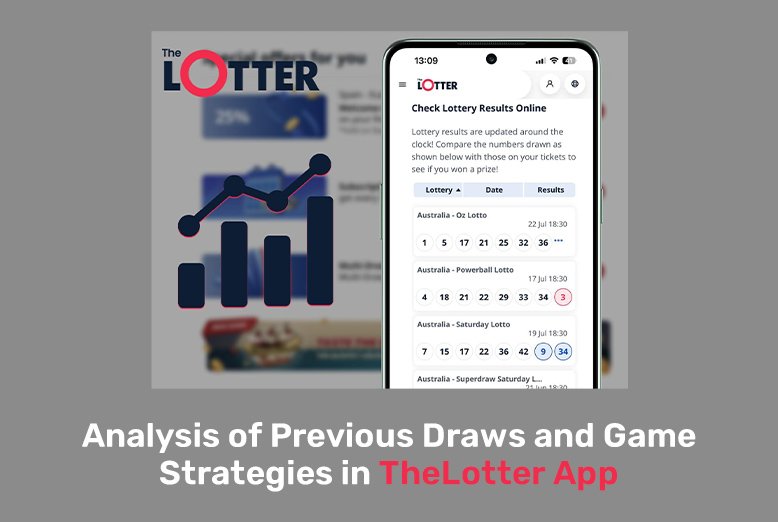

Analysis of Previous Draws and Game Strategies in TheLotter App

The theLotter app provides players with the opportunity not only to participate in world lotteries, but also to view the history of draws, analyze the frequency of numbers, check the dynamics of jackpots and draw conclusions that may influence your choice. However, most participants play without such an approach, relying solely on intuition or “lucky” […]

Why Early Orthopedic Care Matters After an Accident or Fall

Falls and accidents can happen. It can be on the road, in house, office, or just simply while walking. Although there are some injuries that may appear and feel less harmful in the first inspection, but can put you in more threatening conditions if not seen by a qualified orthopedic physician right away. On-time orthopedic […]

How an Electric Scooter Enhances Comfort and Efficiency

Gliding through the city with ease, skipping past fuel stations, and never worrying about traffic congestion again. Sounds ideal, doesn’t it? That’s exactly what an electric scooter offers—a smoother, quieter, and more cost-effective way to travel. It is projected that the revenue of the electric scooter market will reach US$23.85m in 2025, leading to a […]

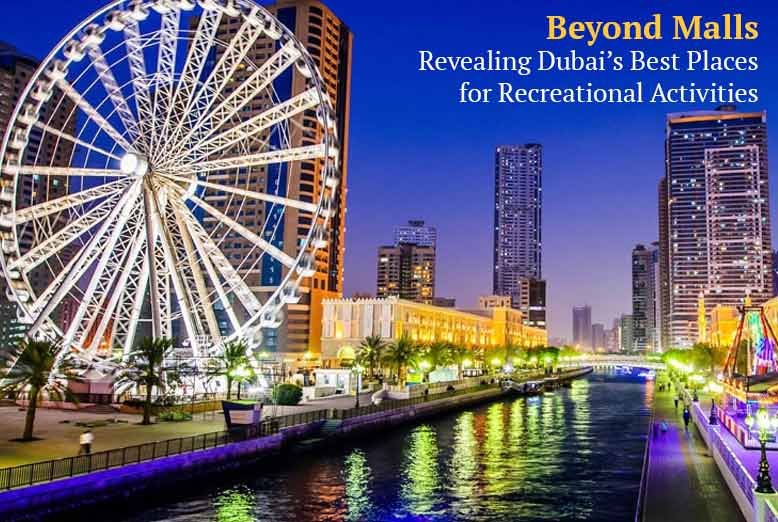

Beyond Malls: Revealing Dubai’s Best Places for Recreational Activities

Although the city’s glitzy malls, air-conditioned shopping boulevards, and glossy skyscrapers are certainly part of Dubai’s appeal, that’s not the whole story. What lies beyond the glistening shops is a vibrant, creative, and adventurous metropolis. Many of the top places to relax in Dubai don’t even have a checkout counter. The city is all about […]

The 6 Best B2B Lead Finder Software Tools for Consistent Sales

Perfecting the lead prospecting stage of your sales funnel is an essential but difficult task. As a business that sells to other businesses, you don’t have a store for clients to wander into or advertisements playing on the TV. Instead, you need to research companies that need the products and services you offer and reach […]