Key Highlights:

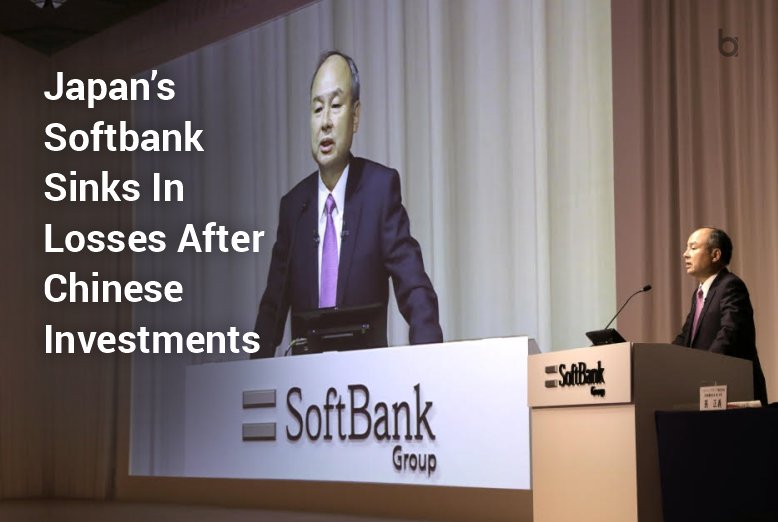

- SoftBank Group Corp. posted a loss for the July-September quarter, weighed down by losses on its Chinese assets.

- According to Masayoshi Son, CEO of SoftBank, the Vision Fund suffered a 1 trillion yen ($9 billion) loss in the July-September quarter.

- He cited a dramatic decline in the share price of Chinese e-commerce behemoth Alibaba, in which SoftBank has a stake.

Weighed down by losses

SoftBank Group Corp. posted a loss for the July-September quarter, weighed down by losses on its Chinese assets, the Japanese technology company announced Nov 10.

SoftBank lost 397.9 billion yen ($3.5 billion) in the fiscal second quarter, compared to a profit of 627 billion yen in the same time the previous year.

Quarterly revenue increased by 11% to 1.5 trillion yen ($13 billion).

SoftBank, based in Tokyo, said its Vision Fund investment portfolio incurred losses, including the value of its interest in South Korean online retailer Coupang. It did, however, report gains on its shares of DoorDash, a San Francisco-based online food-ordering service.

SoftBank stated that China’s recent crackdown on the technology industry has dragged on Chinese share values.

Softbank loses a loss of $9 billion

According to Masayoshi Son, CEO of SoftBank, the Vision Fund suffered a 1 trillion yen ($9 billion) loss in the July-September quarter. The company’s founder, Son, recognized that the new losses were a stark contrast to the roaring earnings recorded in the previous fiscal year.

“We’re heading right into a snowstorm in the middle of winter,” Son told reporters, adding that he’s not going to make excuses.

He cited a dramatic decline in the share price of Chinese e-commerce behemoth Alibaba, in which SoftBank has a stake.

However, he emphasized that SoftBank’s primary business was transitioning to the Vision Fund, making it less reliant on Alibaba’s performance. However, Vision Fund’s Chinese assets fell as well.

Vision Fund’s assets rose in value

Son stated that the Vision Fund’s assets were increasing in value overall. Its portfolio is continually evolving. It used to control Sprint in the United States, but Sprint merged with T-Mobile, in which SoftBank still retains a stake.

SoftBank owns a Japanese mobile carrier that was the first to launch the iPhone in the Japanese market. It has also invested in WeWork, a U.S. office-sharing business, which opponents say was a mistake, although Son claims the company’s performance was improving.

Investments in the U.S. semiconductor manufacturer Arm and the ride-hailing service Uber are two instances of moderately successful investments.

“I believe the Vision Fund is delivering results,” Son remarked. He stated there was still hope, and he showed a video of a little green plant emerging in the snow. “While some of our goose’s eggs have recently perished, the remaining golden eggs are gleaming in glory,” he explained.

Also read: Why Digital Banking is soaring in Asia?